student loan debt relief tax credit application 2021

Any new loans disbursed on or after 1 July. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans.

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

Curadebt is a company that provides debt relief from hollywood florida.

. October 5 2022 107 PM MoneyWatch. How to apply for Marylands student loan debt relief tax credit. About the company student loan debt relief tax credit application 2021 pdf.

Anyone who says they can get you approved for a fee is a scammer. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application.

For unsecured financial debts there are different alternatives such. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

It was established in 2000 and is a part of the. Announced in August will cancel up to 20000 in debt per. Borrowers who have made payments on loans that werent previously eligible for debt.

The deadline to apply for student loan forgiveness is December 31 2023. To get student loan debt canceled participants in IDR plans must have recertified their income data for either 2020 or 2021. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

Follow EDs process if your application is denied. Your income is based on either your 2020 or. In Indiana for example the state tax rate is 323.

More than 40 million borrowers are eligible for student debt relief. One begins to lose rest and feels. The student loan debt relief application is now available for all eligible borrowers according to the Department of Education.

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. The student loan forgiveness application officially. Politics Oct 18 2022 707 PM EDT.

Married borrowers who file their taxes. September 14 2022 757 pm. Your email notice will have instructions.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Under Maryland law the. About the Company Student Loan Debt Relief Tax Credit Application.

The other borrowers who can expect to receive. CuraDebt is a company that provides debt relief from Hollywood Florida. Tax return from 2020 or 2021.

How long the application will be up. The Biden-Harris student debt relief will only apply to federal student loan balances that borrowers had prior to 30 June 2022. Mhec student loan debt relief tax credit program for 2021.

After having promised for months to act on student debt Biden announced in August that he would cancel up to 10000 for many borrowers who earned less than 125000. President Bidens plan to erase up to 20000 in student loans will require millions of borrowers to fill out an application to receive. NEW YORK AP President Joe Bidens student loan forgiveness program.

The state is offering up to 1000 in. 2 days agoBorrowers are eligible for up to 10000 in federal student loan forgiveness if their adjusted gross income is under 125000 annually. In a legal filing the department said it will not discharge any student loan debt under the debt relief plan prior to October 23 2022 The.

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Biden S Stimulus Package Makes Student Loan Forgiveness Tax Free Bankrate

Biden Administration Previews Student Loan Forgiveness Website Cnn Politics

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Student Loan Forgiveness Government Offers Updates On Eligibility

Paying Student Loan Debt Modification Repayment Options

Student Loans How To Apply For Loan Forgiveness Using The New Beta Version Of The Form Marca

What You Need To Know About Biden S Student Loan Forgiveness Plan

The Elm Maryland Higher Education Commission S Student Loan Debt Relief Tax Credit Application

How To Apply For Biden S Student Loan Forgiveness Program Money

More Details Emerge About Biden Federal Student Debt Forgiveness Plan

Can I Get A Student Loan Tax Deduction The Turbotax Blog

How 5 Million Student Loan Borrowers Will Verify Income For Debt Relief

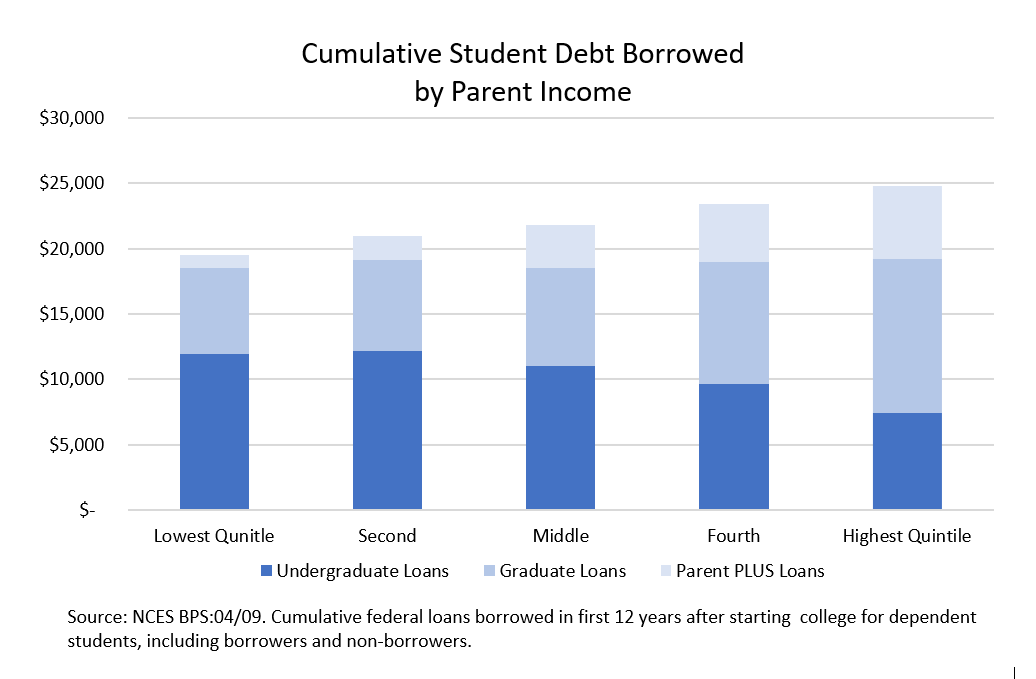

Biden Is Right A Lot Of Students At Elite Schools Have Student Debt

Student Loan Debt Cancellation And Taxes Kiplinger

Can I Get A Student Loan Tax Deduction The Turbotax Blog

President Announces Student Loan Forgiveness Eligibility Details Application And Tax Implications Wolters Kluwer